In recent years, the business landscape has witnessed a transformative shift towards payroll outsourcing services.

As a result, it marks a departure from traditional in-house salary management methods. This evolution stems primarily from the relentless pursuit of efficiency, adaptability, and cost-effectiveness in business operations.

Specifically, when considering the blue-collar workforce segment, the significance of payroll outsourcing becomes even more pronounced. Blue-collar employees, representing the backbone of several industries, necessitate specialised employee salary management systems to ensure timely, accurate, and compliant compensation.

Moreover, with the proliferation of outsourced payroll providers and payroll solutions, businesses now have access to tailor-made services that cater specifically to the nuanced requirements of the blue-collar demographic.

As this guide delves deeper into the realm of payroll outsourcing, it’s essential to recognize its pivotal role in shaping the future of employee salary management for the blue-collar workforce.

What Is Payroll Outsourcing?

How to Define it and what are the Basics?

Payroll outsourcing, at its core, refers to the practice of hiring external outsourced payroll providers to manage an organisation’s entire payroll function.

It is a strategic shift from in-house processes, wherein companies trust third-party experts to handle the intricate details of their employee salary management system. This evolution is not merely a trend but a response to the increasing complexity of payroll regulations, tax codes, and the need for specialised attention to employee compensation.

Especially in sectors abundant with blue-collar workers, payroll outsourcing services offer a structured, compliant, and efficient approach to ensuring employees are compensated accurately and promptly.

What are the Key Components of Outsourced Payroll?

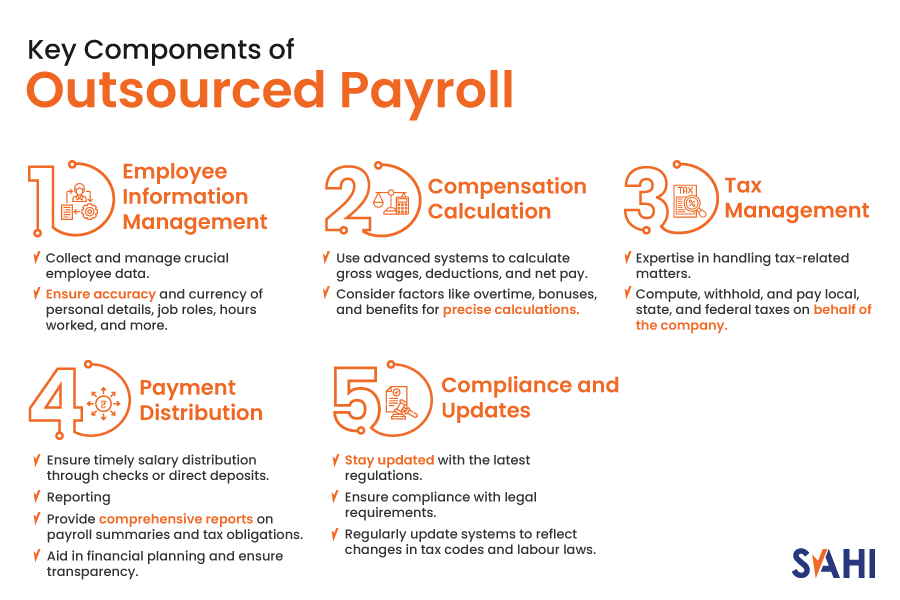

Employee Information Management

One of the primary components, this involves collecting and managing crucial employee data, ensuring all information is current and accurate. The data encompasses personal details, job roles, hours worked, and other relevant specifics.

Compensation Calculation

Outsourced payroll service providers are equipped with advanced systems that can calculate gross wages, deductions, and net pay with precision, taking into account factors like overtime, bonuses, and benefits.

Tax Management

Perhaps one of the most significant advantages of availing the services of the best payroll outsourcing companies is their expertise in handling tax-related matters. This includes computing, withholding, and paying local, state, and federal taxes on behalf of the company.

Payment Distribution

Whether it’s through checks or direct deposits, ensuring that employees receive their salaries on time is a fundamental component of payroll solutions.

Reporting

Comprehensive reports on payroll summaries, tax obligations, and other financial data are routinely provided by payroll management companies. This aids in the company’s financial planning and ensures transparency.

Compliance and Updates

Outsourced payroll services stay abreast of the latest regulations, ensuring that the payroll process aligns with legal requirements. Their systems are often updated to reflect any changes in tax codes or labour laws.

Why Outsource Payroll?

What is the reason for the Rise of Outsourced Payroll Services?

In today’s fast-paced corporate landscape, businesses are always seeking innovative ways to optimise operations and enhance efficiency.

One such strategy that has seen a remarkable surge is the adoption of outsourced payroll services. With increasing regulatory complexities and the undeniable importance of accurate and timely compensation, many enterprises now recognize the inherent challenges of managing payroll in-house.

This recognition, combined with the emergence of specialised payroll service providers offering tailored payroll solutions, has precipitated the significant growth of the payroll outsourcing industry. Specifically tailored for diverse workforce categories, including blue and grey-collar employees, outsourced payroll services have emerged as a compelling solution for modern businesses.

What Are The Advantages of Outsourcing Payroll Services?

Cost Efficiency

Engaging with best payroll outsourcing companies often translates to substantial cost savings. Businesses can avoid the overhead expenses associated with in-house teams, such as hiring, training, and payroll software purchases.

Compliance Assurance

Given the ever-evolving labyrinth of labour laws and tax regulations, ensuring compliance is paramount. Payroll outsourcing services bring expertise and updated knowledge, significantly reducing the risk of costly penalties or legal entanglements.

Resource Allocation

Outsourcing payroll allows businesses to redirect vital internal resources towards core operations. This strategic shift enhances overall productivity and drives growth, as teams can focus on primary business objectives rather than administrative tasks.

Employee Satisfaction

Accurate and timely compensation is a cornerstone of employee morale. Outsourced payroll providers ensure that payment glitches are minimal, leading to higher employee satisfaction and, in turn, improved retention rates.

Scalability

As businesses grow, their payroll needs evolve. One of the hallmarks of premier payroll management companies is the flexibility they offer.

Moreover, companies can easily scale services up or down based on requirements, ensuring seamless transitions during expansion phases or downsizing.

What is the Impact on the Blue and Grey Collar Workforce?

The blue-collar workforce, comprising skilled workers primarily involved in manual labour, represents a substantial segment of the global employment structure.

These employees, ranging from technicians and craftsmen to factory workers and mechanics, play a pivotal role in driving industries forward. Thus, ensuring an effective employee salary management system for this segment is not just essential but also presents unique challenges.

Thus, payroll outsourcing has emerged as a potent solution in addressing these intricacies.

What are some Unique Payroll Challenges?

For the blue-collar demographic, payroll processing differs significantly from its white-collar counterparts. Here are some challenges unique to them:

Variable Work Hours

Unlike traditional office workers, blue-collar employees often work in shifts, which might include overtime, weekend duties, or even night shifts. Calculating compensations based on these variable hours can be complex and requires meticulous tracking.

Seasonal Employment

Industries like agriculture or construction often hire blue-collar workers on a seasonal basis. This cyclic nature of employment necessitates a flexible payroll solution to handle onboarding and offboarding efficiently.

Diverse Compensation Structures

Apart from hourly wages, blue-collar workers might also receive performance-based bonuses, hazard pay, or other allowances, making the compensation structure multi-faceted.

Physical Paychecks

While the world is moving towards digital payments, many blue-collar workers still prefer physical paychecks. This preference introduces logistical challenges in timely and secure paycheck distribution.

Regulatory Compliance

Given the nature of their jobs, blue-collar workers are often subject to specific labour laws, safety regulations, and union agreements. Ensuring compliance with these while processing payroll is crucial.

What are some Tailored Solutions for Blue-Collar Employees?

Recognizing the distinct payroll needs of the blue-collar workforce, many best payroll outsourcing companies have crafted specialised services:

Advanced Time-Tracking Systems

With state-of-the-art tracking solutions, payroll service providers can accurately capture work hours, breaks, and overtime, ensuring fair compensation.

Flexible Payroll Cycles

Catering to the cyclic nature of some blue-collar jobs, outsourced services offer adaptable payroll cycles, whether bi-weekly, weekly, or even daily.

Integrated Bonus Calculations

Modern payroll solutions seamlessly integrate performance metrics to calculate and disburse bonuses without manual interventions.

Hybrid Payment Modes

Acknowledging the diverse payment preferences, payroll management companies provide both electronic transfers and physical paycheck options.

Comprehensive Compliance Tools

Leveraging advanced tech, these payroll solutions automatically update regulatory changes, union agreements, or safety norms, ensuring that the payroll process remains compliant.

What is Compliance and Risk Management in Payroll Outsourcing?

In the intricate world of payroll, compliance stands as a beacon of paramount importance.

Given the severe legal and financial consequences of non-compliance, businesses are perpetually on the lookout for ways to ensure their operations remain within the bounds of the law.

Payroll outsourcing services, with their expertise and dedicated resources, can significantly mitigate risks associated with payroll management, especially when dealing with the blue and grey-collar workforce.

What are the Legal Considerations?

The realm of payroll is heavily governed by a slew of laws, both at the federal and local levels. These legal frameworks include:

Taxation Laws

They dictate the amount of tax to be deducted from an employee’s salary, ensuring that organisations pay their due taxes in a timely manner.

Labour and Employment Laws

Specific to regions and job types, these laws oversee wage limits, overtime calculations, and other employee rights.

Data Protection Regulations

Given the sensitive nature of payroll data, there are stringent laws in place to ensure that employee information remains confidential and is not misused.

Industry-specific Norms

Especially relevant for blue and grey-collar sectors, certain industries have their specific regulations, be it related to hazard pay, insurance, or other compensation structures.

How to ensure Compliance with Outsourced Payroll Providers?

Expertise

The best payroll outsourcing companies possess in-depth knowledge of current regulations and continuously update their systems in response to any legal changes.

Automated Systems x

Many outsourced payroll providers leverage advanced tech to automatically calculate taxes, benefits, and other deductions in compliance with legal mandates.

Regular Audits

Top payroll solutions often include regular compliance audits, ensuring that the payroll process is consistently aligned with legal requirements.

Training and Updates

Payroll service providers routinely train their staff, ensuring they are well-versed with the latest compliance demands. They also keep their clients informed of any significant legal changes.

Secure Data Management

Recognizing the importance of data protection laws, these services invest heavily in robust data security measures, guaranteeing the integrity and confidentiality of sensitive employee data.

What are the Strategic Benefits of Payroll Outsourcing?

In today’s dynamic business environment, the strategic advantages of payroll outsourcing extend far beyond just cost savings.

Delving deeper reveals how this approach aligns seamlessly with an organisation’s broader objectives, especially when harnessing the potential of blue and grey-collar workforces.

Resource Allocation and Efficiency

Outsourcing payroll paves the way for companies to reallocate crucial resources to core functions.

Instead of being mired in administrative tasks, teams can channel their energies towards innovation and growth. Enhanced efficiency is a natural byproduct, as payroll solutions streamline operations, eliminating redundancies.

The Role of Best Payroll Outsourcing Companies

The cream of payroll service providers bring to the table unparalleled expertise and cutting-edge technologies.

These companies don’t just offer services; they partner with businesses, tailoring solutions that foster adaptability, scalability, and compliance. Their role becomes instrumental in ensuring businesses thrive, even in the face of evolving challenges.

What is the Cost Analysis of Payroll Outsourcing?

Embarking on the journey of payroll outsourcing necessitates a thorough understanding of its financial dimensions.

When weighed against traditional in-house operations, the cost dynamics of outsourcing reveal interesting insights, especially beneficial for sectors employing blue and grey-collar workforces.

Financial Implications and Savings

Outsourcing doesn’t just shift the payroll task off a company’s plate; it often leads to direct financial benefits.

The hidden costs of in-house operations, like software updates, training, and potential compliance fines, can be substantial. Outsourced payroll providers, with their economies of scale and expertise, frequently offer more competitive rates, translating to tangible savings.

Moreover, by avoiding errors and ensuring timely payments, businesses can avert costly penalties.

Evaluating Payroll Management Companies

Cost should never be the sole determinant. When exploring payroll management companies, it’s vital to assess the value offered.

While some might have lower rates, their service quality, tech infrastructure, and adaptability are equally crucial. A holistic evaluation, juxtaposing costs against benefits, ensures businesses derive maximum value from their payroll outsourcing endeavours.

What is the Long-Term Impact of Outsourcing?

Outsourcing, especially in the realm of payroll, doesn’t merely present immediate advantages.

The ripple effects of this strategic decision reverberate through the organisation’s future, sculpting a trajectory characterised by adaptability and resilience, particularly for blue-collar workforces.

How will the Workforce Adapt and Grow Resilient?

Embracing payroll outsourcing services facilitates a more flexible operational model.

As businesses evolve and industries undergo shifts, having an outsourced model allows for rapid adjustments without overhauling internal structures. This elasticity inherently boosts workforce resilience, enabling employees to stay focused on core competencies, assured that their compensations are managed by the best in the business.

Conclusion

Understanding payroll outsourcing isn’t just an administrative necessity; it’s pivotal to the strategic growth and resilience of modern organisations.

As the demands of workforce management evolve, especially within blue-collar sectors, the nuances of outsourced payroll solutions become increasingly vital.

SAHI envisions a future where workforce management transcends traditional boundaries, fostering innovation and excellence. By integrating payroll outsourcing into their strategies, businesses inherently align with SAHI’s ethos.

This synergy ensures that while businesses march forward, they’re buttressed by robust, compliant, and efficient payroll systems tailored to their unique needs. So, as you stand at the crossroads of decision-making, let the insights into payroll outsourcing guide your steps towards an optimised, future-ready workforce.