In the rapidly evolving business landscape, effective payroll management for blue and grey collar workers has become a pivotal concern for organisations worldwide.

Employee expectations, regulatory landscapes, and technological advancements have undergone significant transformations. Thus, companies face an imperative decision: should they manage their payroll in-house or explore payroll outsourcing services?

Both options have their merits for blue and grey collar workers, and the choice often depends on a multitude of factors, from organisational size to its specific operational needs. Opting for the best payroll outsourcing companies can offer specialised expertise and streamlined operations.

In contrast, managing payroll internally may provide more direct control. However, as businesses evaluate the benefits of outsourcing payroll against in-house solutions, it becomes evident that this decision can significantly influence operational efficiency, compliance, and overall company morale.

Understanding the Basics

What is In-House Payroll?

In-house payroll for blue and grey collar workers refers to the traditional method where businesses manage their payroll operations internally, leveraging their resources and tools.

This approach allows organisations direct control over payroll processes, right from calculating employee salaries to ensuring tax compliance. Typically, companies that choose in-house methods invest in specialised payroll software, ensuring accuracy and timeliness.

While this approach allows for instant access and adjustments, it also requires a dedicated team or individual familiar with payroll regulations and laws.

What are Payroll Outsourcing Services?

Payroll outsourcing services are provided by third-party companies or outsourced payroll providers specialised in managing payroll operations for other businesses.

These payroll outsourcing companies offer a comprehensive suite of services ranging from salary calculations and disbursement to tax filing and compliance management. Thus, by outsourcing, companies can tap into the expertise of these providers, ensuring accuracy, compliance, and efficiency without the need for in-house expertise or tools.

Moreover, for businesses that lack the bandwidth or expertise, turning to the best payroll outsourcing companies can be a strategic move. This is because it allows them to focus on core functions while the payroll intricacies are handled by experts.

What is the Importance of Third-Party Managed Payroll?

Third-party managed payroll plays a pivotal role in the blue and grey collar industry.

Primarily, it ensures accuracy and compliance. Given the complex, ever-evolving labor laws and tax codes, outsourcing payroll minimizes risks of errors and non-compliance. It also provides scalability.

As blue and grey collar industries often experience fluctuations in workforce size, third-party providers can efficiently scale up or down as needed. Additionally, these providers have the technology and infrastructure to manage bulk payroll, offer electronic pay solutions, and maintain records, thereby streamlining processes.

Outsourcing also allows industry leaders to focus on their core operations without getting bogged down by administrative burdens. In essence, third-party managed payroll ensures efficiency, accuracy, and compliance in the dynamically changing blue and grey collar sectors.

What Is The Difference Between In-house and Outsourced Payroll?

Choosing between managing payroll in-house and opting for payroll outsourcing services can be pivotal for an organisation’s efficiency and compliance.

To simplify this decision, we’ve tabulated the key distinctions, capturing the pros and cons of each option.

| Aspect | In-House Payroll | Payroll Outsourcing Services |

| Control | High direct control over processes and data | Lesser direct control, dependent on provider |

| Cost | Recurring costs for software, staff, and training | Often a fixed fee or per-employee charge |

| Expertise | Requires internal expertise and regular training | Access to specialised expertise |

| Adaptability | Time-intensive to adapt to regulatory changes | Providers ensure up-to-date compliance |

| Efficiency | Dependent on in-house processes and tools | High efficiency with streamlined services |

| Integration | Seamless with internal systems | May require integration with external tools |

| Compliance Risks | Potential risks if not regularly updated | Often minimised with outsourced payroll solutions |

| Scalability | Can be challenging to scale up or down rapidly | Flexible, scalable as per business needs |

Pros of In-House Payroll:

- Direct control

- Seamless integration with other internal systems

Cons of In-House Payroll:

- Potential compliance risks

- Requires continuous internal expertise and training

Pros of Payroll Outsourcing Services:

- Access to specialised expertise

- Scalability and flexibility with business needs

Cons of Payroll Outsourcing Services:

- Lesser direct control

- Possible integration challenges with existing systems

Advantages of In-House Payroll

Control and Customization

One of the most significant benefits of managing payroll in-house for blue and grey collar workers is the unparalleled control it offers organisations. With direct oversight, businesses can ensure that every aspect of the payroll process aligns precisely with their requirements and standards.

Such a level of control allows for real-time customization and adjustments, accommodating any immediate or long-term organisational changes. For instance, as a company scales or undergoes structural shifts, the in-house payroll team can swiftly adapt without waiting for third-party intervention or adjustments.

Integration with Internal Systems

In-house payroll systems are inherently built to be cohesive with an organisation’s other internal tools and platforms. This seamless integration ensures that data flows smoothly across departments, eliminating the need for redundant entries or reconciliations.

For instance, the HR system’s data can be directly utilised for payroll calculations without any additional transfers. This not only minimises the potential for errors but also enhances operational efficiency.

Direct Communication

Facilitating direct communication is another hallmark advantage of in-house payroll management for blue and grey collar workers. Should there be any discrepancies, queries, or last-minute changes, employees can liaise directly with the payroll department, ensuring immediate resolution.

This streamlined communication minimises misunderstandings and fosters a transparent work environment. On the other hand, with outsourced payroll solutions, there might be a communication lag or dependence on external partners to relay and address concerns.

Challenges of In-House Payroll

Compliance Risks

Managing payroll in-house brings the challenge of ensuring consistent compliance with ever-evolving tax laws, regulations, and industry standards. Without dedicated specialists on board, businesses might overlook critical updates, exposing themselves to potential legal and financial penalties.

While payroll outsourcing services usually offer the advantage of dedicated teams staying abreast of these changes, in-house teams must proactively invest in training and updates to mitigate these compliance risks. Failure to do so can compromise the benefits of having direct control over the process.

Resource Allocation

Allocating adequate resources for blue and grey collar workers is a perennial concern with in-house payroll management. This isn’t just about budgeting for payroll software or tools; it extends to hiring, training, and retaining skilled payroll staff.

As businesses scale or their needs evolve, this resource allocation becomes increasingly complex, requiring continuous investment. In contrast, turning to the best payroll outsourcing companies often translates to predictable costs and scalability on-demand.

Potential for Human Error

Every manual process brings with it the potential for human errors, and in-house payroll is no exception. Mistakes in data entry, miscalculations, or oversight can lead to inaccurate salary disbursements, tax filings, or even compliance issues.

While automation and payroll software aim to minimise these errors, the human touchpoints in the process still present vulnerabilities. Outsourced payroll solutions, with their specialised expertise and dedicated focus, often employ rigorous checks to minimise such errors.

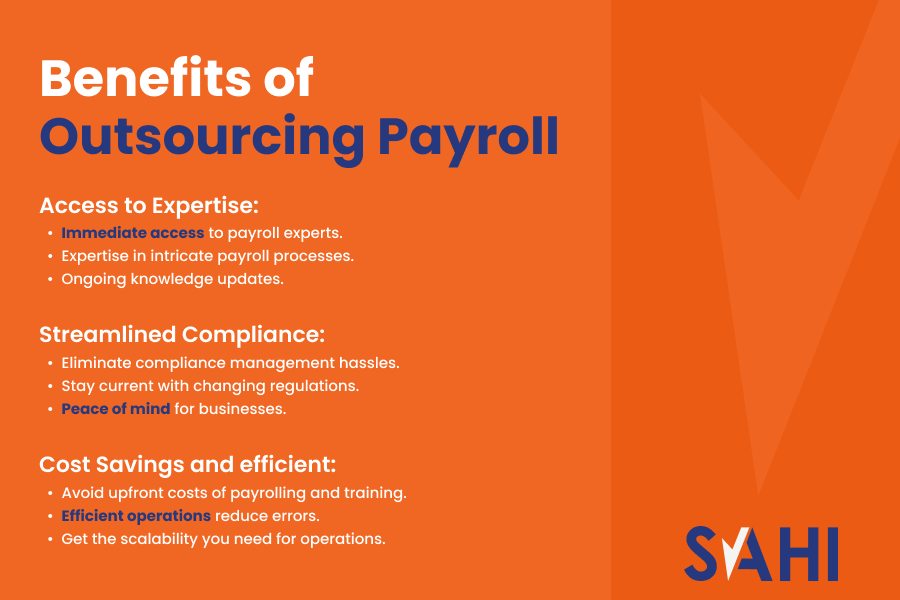

Benefits of Outsourcing Payroll

Now, what are the benefits of outsourcing payroll that you should know –

Access to Expertise

One of the standout benefits of opting for payroll outsourcing services is the immediate access to a pool of experts specialising in payroll processes. These professionals are well-versed with the intricate nuances of payroll management, ensuring that businesses get the best advice and service.

Unlike an in-house setup where constant training and upskilling might be necessary, payroll outsourcing companies already possess the expertise and keep updating their knowledge base in line with industry standards.

Streamlined Compliance

Regulatory compliance is paramount in payroll management, and keeping abreast of the constantly changing regulations can be a monumental task for businesses. This is where outsourced payroll providers shine.

They have dedicated teams focusing solely on regulatory shifts, ensuring that the payroll process is always compliant. The peace of mind this offers to businesses is invaluable.

Instead of navigating the labyrinthine corridors of tax codes, deductions, and employee regulations, companies can rely on their outsourced partners to manage these aspects. As a result it helps in minimising risks and enhancing operational integrity.

Cost and Efficiency

While it might seem counterintuitive, outsourcing payroll can lead to substantial cost savings in the long run. By engaging with the best payroll outsourcing companies, businesses can eschew the costs associated with buying and maintaining payroll software, training personnel, and managing compliance updates.

Moreover, with a dedicated entity handling payroll, the process becomes significantly more efficient. The streamlined operations ensure timely and accurate payroll cycles, reducing the likelihood of costly errors.

Potential Downsides of Outsourcing Payroll

Less Direct Control

One of the immediate concerns when considering payroll outsourcing services is the loss of direct control over the payroll process.

Unlike in-house management, where companies can make real-time adjustments and modifications, outsourcing requires relaying changes through a third-party, which can sometimes delay responses. Moreover, this lack of immediate control can be especially palpable during times of rapid organisational changes or unique payroll situations that demand swift actions.

Also, while payroll outsourcing companies strive to be as adaptable as possible, they can’t match the direct oversight offered by in-house setups.

Integration Challenges

While the best payroll outsourcing companies offer comprehensive solutions, integrating their systems with a business’s existing platforms can sometimes be challenging.

There might be compatibility issues, data transfer bottlenecks, or redundancies that require manual intervention. Such integration hurdles can reduce the efficacy of the payroll process, possibly leading to data discrepancies or inefficiencies.

Dependency on External Partners

Relying on outsourced payroll solutions means placing a significant portion of trust in external partners.

While these providers specialise in payroll management, any operational disruptions on their end – technical glitches, policy changes, or staffing issues – can have a direct impact on a company’s payroll process. This dependency can sometimes lead to unforeseen delays or challenges, which wouldn’t typically arise in an in-house setting.

Strategic Cost Analysis

Cost Implications of Both Options

When comparing in-house payroll management with payroll outsourcing services, it’s essential to evaluate the broader cost implications of each approach.

In-house setups often come with upfront costs like software acquisition, personnel hiring, and ongoing training. Over time, the need for software upgrades, compliance updates, and potential error rectifications can add to the expenses.

On the other hand, partnering with payroll outsourcing companies might involve a fixed monthly or annual fee.

While this seems straightforward, it’s crucial to consider additional charges for extra services or costs associated with integration. Moreover, while outsourcing, the long-term return on investment becomes a significant factor in the overall cost calculations.

Achieving Cost-Effectiveness

The goal for most businesses is not just to minimise costs but to achieve genuine cost-effectiveness. This means extracting the maximum value for every dollar spent.

For companies with fluctuating payroll needs or those in growth phases, the flexibility and scalability offered by outsourced payroll providers can translate to real cost savings. Conversely, businesses with a stable, well-established workforce might find in-house setups more cost-effective due to reduced variability.

Additionally, the intangible benefits, like direct control in in-house setups or access to expertise in outsourcing, need to be factored into the cost-effectiveness equation.

Long-Term Effects on Workforce Adaptability

Aligning Payroll Choices with Organisational Resilience

For organisations aiming to maintain a competitive edge in today’s fast-paced business environment, adaptability is key. The choice between in-house payroll management and payroll outsourcing services significantly influences this adaptability.

In-House Payroll Offers direct control

Opting for in-house setups provides businesses with direct control, allowing for quick pivots in response to changing internal needs. However, it might limit access to the latest industry best practices, unless continuous investments in training and technology are made.

Outsourcing Guarantees Up-To-Date Info

In contrast, payroll outsourcing companies ensure that businesses always operate with up-to-date knowledge and technologies. As a result, it fosters adaptability in response to external market shifts and regulatory changes.

Hence, aligning payroll choices with organisational resilience necessitates a foresight into factors – internal adaptability or external responsiveness. Thus, these are pivotal for the business’s long-term success.

Ensuring a Future-Ready Blue-collar Workforce

In industries heavily reliant on blue-collar workers, the importance of a future-ready workforce cannot be understated. Effective payroll management, whether in-house or outsourced, plays a crucial role in this preparedness.

Accurate And Prompt Compensation

Workers need assurance of timely and accurate compensation, which boosts morale and productivity. By partnering with outsourced payroll providers, companies can ensure that their blue-collar workers benefit from best-in-class payroll practices, enhancing job satisfaction and long-term retention.

In-House Payroll Creates A Sense of Belonging

Conversely, an in-house setup, when efficiently managed, offers workers a sense of belonging and direct communication, strengthening organisational ties. The challenge lies in determining which approach best aligns with the company’s vision for its blue-collar workforce in the years to come.

Tailoring the Decision: Insights for CHROs, Business Unit Heads, and CEOs

Recommendations for CHROs

For Chief Human Resource Officers (CHROs), the decision between in-house and payroll outsourcing services hinges on balancing immediate HR needs with long-term workforce strategies.

CHROs should consider how each option aligns with talent acquisition, retention, and overall employee satisfaction. While in-house solutions offer a sense of closeness and direct communication, partnering with payroll outsourcing companies can provide cutting-edge practices that attract and retain top talent.

This is especially true in industries with significant blue-collar demographics. Thus, CHROs must assess which model best supports their overarching HR objectives and vision.

Strategies for Business Unit Heads

For Business Unit Heads, operational efficiency is paramount.

When evaluating payroll services, it’s vital to gauge how each option impacts the unit’s bottom line and ability to meet specific objectives. In-house setups might offer tighter integration with existing systems, streamlining operations.

However, outsourced payroll solutions can bring in specialised expertise, potentially driving higher efficiencies, especially during market fluctuations. Business Unit Heads should also assess the adaptability of each option.

Guiding Principles for CEOs

At the helm, CEOs must consider the broader business implications of their payroll choices. Beyond the immediate cost implications, CEOs should evaluate how the decision aligns with the company’s brand ethos, strategic growth targets, and long-term sustainability.

While in-house setups can provide a sense of ownership and integration, payroll outsourcing services can offer scalability, industry insights, and risk mitigation. Given the pivotal role of payroll in cultivating a resilient and adaptable workforce, CEOs must anchor their decision in a vision that encompasses the present and the future landscape.

Conclusion

In the evolving landscape of business management, the decision between in-house and payroll outsourcing services offers unique value propositions.

In-house payroll affords direct control and seamless integration, while outsourcing extends access to unparalleled expertise and streamlined compliance. As organisations grapple with these options, it’s imperative for decision-makers to align their choice with the broader organisational strategy.

This is especially important when considering the unique demands of blue-collar workforces.

But how will you meet the demands of workers? The answer is SAHI, a one-stop solution for businesses to rethink workforce payrolling and payroll transfers.

With over 14 years of experience across multiple sectors, SAHi has been leading the way for businesses, aiming to optimise payroll management. It offers a blend of innovation and expertise, while their tailored payroll services bridge the gap between in-house ownership and outsourced efficiency.

This ensures that businesses, irrespective of their size or industry, benefit from the best of both worlds.

You can trust in SAHI’s commitment to redefining how the industry views payroll solutions for blue-collar workers. Thus, ensuring your workforce’s contentment and your company’s growth.