In today’s fast-paced world, managing payroll efficiently is not just an operational need but a strategic imperative. A seamless payroll process is crucial to an organisation’s success, impacting not just its financial bottom line but also its reputation and workforce morale.

However, many CHROs, CEOs, and Business Unit Heads often find themselves navigating the choppy waters of inefficient payroll systems.

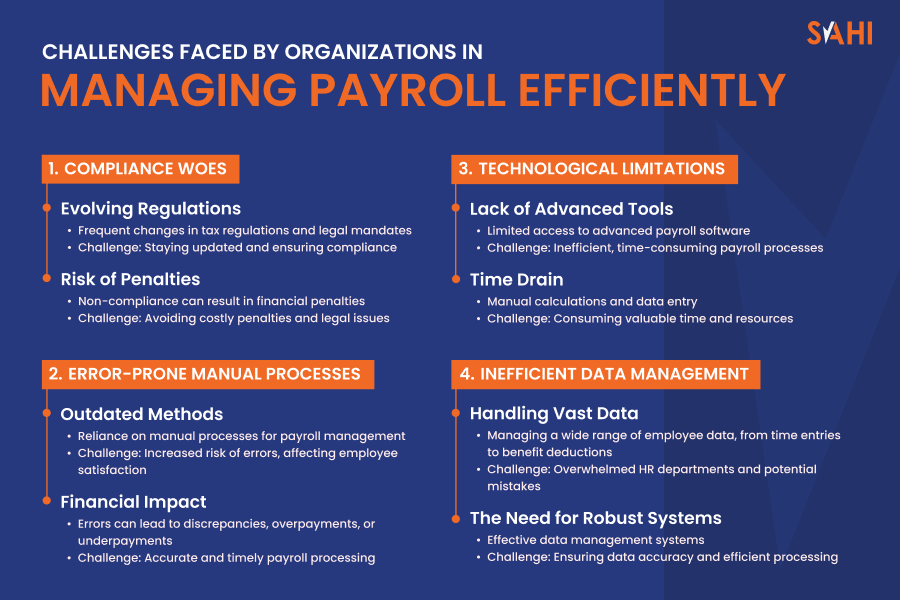

Challenges Faced by Organizations in Managing Payroll Efficiently

Despite the advancements in technology and the myriad of tools available, many organisations still grapple with the complexities of payroll management. Here are some challenges they face:

- Compliance Woes: The landscape of payroll compliance is ever-evolving, with new tax regulations and legal mandates frequently coming into play. Ensuring adherence to these changes can be daunting, leading to potential penalties if overlooked.

- Error-prone Manual Processes: Many organisations still rely on outdated manual processes for payroll, resulting in errors that can lead to financial discrepancies, overpayments, or even underpayments.

- Technological Limitations: Not every organisation has access to advanced payroll software, making the payroll process cumbersome and time-consuming.

- Inefficient Data Management: Handling vast amounts of employee data, from time entries to benefit deductions, can become overwhelming, leading to potential mistakes if not managed with a robust system in place.

The Significance of an Optimised Payroll Function

Payroll, often viewed as a mere administrative task, is much more than just crunching numbers. An efficient payroll system plays a pivotal role in an organisation’s overall health.

- Employee Satisfaction: A timely and accurate payroll processing ensures that employees are compensated as per their due. This not only boosts their morale but also ensures trust in the organisation’s processes.

- Financial Integrity: With payroll often being one of the largest expenses for businesses, ensuring its accuracy is paramount. An efficient payroll system guarantees that every penny is accounted for, upholding the company’s financial integrity.

- Compliance and Risk Management: An optimised payroll function, supported by the latest payroll compliance tools, ensures that the organisation remains compliant with the latest tax regulations, avoiding hefty penalties and legal hassles.

- Strategic Business Decisions: With a streamlined payroll process, CHROs and CEOs can have accurate data at their fingertips. This can aid in making strategic business decisions, from budgeting to workforce planning.

The Current Landscape of Payroll Management: Delving into Today’s Systems

As businesses evolve, so do their needs and challenges, especially in the realm of payroll management. Today’s payroll systems, while more advanced than their predecessors, are far from perfect.

From small businesses to multinational corporations, payroll management remains a critical function that demands constant attention and refinement.

Traditional Payroll Systems

Traditionally, organisations relied on manual payroll systems, involving physical ledgers, timesheets, and manual calculations. While some businesses, especially smaller ones, still use this approach, it is rapidly becoming obsolete.

Pros

- Complete control over payroll data.

- No reliance on technology, thus no tech failures.

Cons

- Highly time-consuming.

- Prone to human errors leading to discrepancies in payment.

- Difficulty in handling payroll compliance and tax updates.

Outsourced Payroll Systems

Recognizing the complexities of in-house payroll management, many businesses are turning to third-party payroll companies or payroll outsourcing solutions.

Pros

- Experts handle the intricacies of payroll, ensuring accuracy and compliance.

- Allows businesses to focus on core operations.

- Scalable solutions catering to growing businesses.

Cons

- Less direct control over payroll data.

- Dependence on the reliability of the outsourced payroll providers.

- Possible hidden costs or fees.

Apart from these, many organisations have shifted to software-based solutions, ranging from basic software to advanced payroll services. These tools automate many payroll tasks, reducing the likelihood of errors.

Pros

- Automation of repetitive tasks.

- Easier to manage payroll compliance.

- Provides a centralised database for payroll data.

Cons

- Initial setup can be complex.

- Potential software glitches can disrupt the payroll process.

- Regular updates are required to ensure compliance and functionality.

Challenges Posed by Existing Systems, Especially for Large Organisations

- Scalability Concerns: For multinational companies or those with a diverse workforce, scalability is paramount. As the organisation grows, the payroll system should seamlessly cater to an increasing number of employees, varied compensation structures, and diverse geographical locations.

- Compliance and Regulation Hurdles: With employees spread across different regions or countries, staying compliant with varied tax laws and labour regulations becomes a mammoth task, increasing the risk of legal repercussions.

- Data Security and Privacy: In the age of digital threats, ensuring the security of sensitive payroll data is crucial. Large organisations are often prime targets for cyberattacks, making robust data protection mechanisms essential.

- Integration with Other Systems: Large organisations often use multiple software solutions for different functions. Ensuring seamless integration of the payroll system with HRM, CRM, and other tools is vital for smooth operations.

Outsourced Payroll: A Balanced Examination of its Pros and Cons

As organisations navigate the intricate maze of payroll management, one strategy frequently emerges as a promising solution: outsourcing. While third-party payroll services promise efficiency and expertise, they also come with their own set of challenges.

In this section, we’ll dive deep into the pros and cons of payroll outsourcing to aid organisations in making an informed decision. Outsourcing payroll functions to specialised payroll companies or services can bring a myriad of benefits to the table:

- Expertise on Tap: Payroll outsourcing often means that you’re hiring a team of experts who are up-to-date with the latest in payroll compliance, tax regulations, and industry best practices. Their core focus is to ensure that your payroll is managed accurately and efficiently.

- Cost Savings: While there’s a cost associated with hiring outsourced payroll providers, in the long run, it can lead to significant savings. By eliminating the need for in-house payroll staff, software, and infrastructure, businesses can redirect resources to other vital areas.

- Time Efficiency: No more pouring over spreadsheets or updating payroll software. By outsourcing, organisations can free up time and resources, allowing them to focus on core business functions.

- Enhanced Data Security: Reputed payroll services invest heavily in state-of-the-art security measures, from encrypted servers to regular security audits. This ensures that sensitive payroll data remains protected against potential breaches.

- Scalability: As your business grows, a good outsourced payroll provider can scale their services to meet your expanding needs, whether you’re hiring more employees or entering new markets.

The Downsides to Consider

However, payroll outsourcing is not without its challenges. Here are some potential drawbacks to consider:

Less Direct Control

When payroll functions are handled externally, organisations may feel they have less direct control over the process, which can be a concern for some.

Potential Hidden Costs

While outsourcing can offer cost savings, it’s essential to read the fine print. Some providers may have additional fees for services beyond the basic package or penalties for contract terminations.

Communication Barriers

Relaying information back and forth with an external provider might lead to communication gaps, especially if they are in a different time zone or have a different working culture.

Dependence on Service Providers

Should the third-party payroll service face technical issues, outages, or even business discontinuation, it could disrupt the payroll process for the organisation.

When Does Outsourcing Make Sense?

Considering the benefits and drawbacks, outsourcing payroll often makes sense for:

Organisations looking for expertise

Especially if they lack in-house expertise or find it challenging to keep up with payroll compliance and regulations.

Growing businesses

Companies expanding rapidly can benefit from the scalability offered by outsourced providers.

Companies with a diverse workforce

Those spread across different geographical locations might find it easier to rely on experts familiar with regional regulations.

Large-Scale Hiring

It also plays an important role when hiring a large number of blue-collar workers when a business is trying to scale. Thus, they can increase their payrolling capacity.

Case Study on Successful Payroll and Payrolling Transfers Implementation

In the realm of business operations, especially for large-scale corporations, payroll management remains an essential yet intricate task. Multiple organisations have recognized the necessity to optimise their payroll systems and, in this journey, have embraced SAHI’s premium payroll services.

Through real-world case studies, we gain insights into the successful adoption of SAHI’s services and the strategic advantages they’ve conferred upon these enterprises.

DHL Supply India Private Limited: A Success Story in Payroll Optimization

Background

DHL Supply India Pvt. Ltd., an industry titan in contract logistics, prides itself on crafting bespoke logistics solutions. Their operational excellence ranges from warehousing and transportation to delivering finished goods, a testament to their unmatched industry acumen, global reach, and localised expertise.

Industry:

Transportation, Logistics, Supply Chain, and Storage Location: Bangalore, Karnataka

The Challenge

DHL’s ambition to bolster its workforce with 200-300 adept individuals came with inherent challenges. They sought candidates with specific educational and physical criteria, along with the adaptability to accommodate varying work shifts.

SAHI’s Robust Solution

As DHL’s challenges grew, the need for comprehensive solutions became indispensable. What DHL required was a workforce management solution to hire staff and streamline payroll services by using outsourced payroll systems. That’s where SAHI comes in, with over 14 years of industry experience to deliver smooth results.

Sourcing

We spearheaded the quest to unearth suitable candidates. This involved a meticulous screening protocol, culminating in two rigorous interview rounds, ensuring the alignment of the aspirants with DHL’s stringent criteria.

Payrolling

Our partnership didn’t stop at sourcing. SAHI seamlessly incorporated the entire payrolling gamut for the selected candidates, delivering both efficiency and reducing administrative encumbrances for DHL.

Accommodation

Going above and beyond, we recognized the vitality of an amiable working environment. Thus, we arranged for accommodation and nourishment, fostering an ambiance conducive to productivity.

The Outcome

With SAHI’s intervention, the results were sterling. We proficiently sourced and managed payrolling for 112 candidates. Key achievements included:

Focus on Core Activities

With SAHI’s end-to-end recruitment and payrolling services, DHL could pivot its attention to its core activities, ensuring streamlined operations.

Efficient Talent Acquisition

Our expertise facilitated DHL in acquiring a reservoir of qualified candidates, refining their in-house endeavours.

Timely Compensation

With SAHI at the helm of the payrolling function, the candidates received their compensation both timely and accurately.

Companies like DHL, with their global stature and commitment to excellence, require partners who mirror their ethos. SAHI’s strategic interventions have not only addressed immediate needs but have also paved the way for sustainable growth and efficiency. The case of DHL serves as a testament to the transformative potential of well-implemented staffing & payroll solutions.

Best Practices and Common Pitfalls in Payroll Management: Navigating the Complex Terrain

Payroll management, while fundamental to any organisation, is riddled with potential challenges. Whether it’s ensuring accurate compensation or adhering to ever-evolving compliance mandates, the intricacies can be daunting.

This section will offer a guide to the best practices that pave the way for efficient payroll management and highlight common pitfalls that organisations should steer clear of. Embracing these tried and tested strategies can transform your payroll processes, ensuring precision, compliance, and heightened employee morale:

- Regular Training and Updates: Ensure that your payroll team is consistently updated with the latest tax codes, labour laws, and payroll solutions. Regular training sessions can equip them with the requisite knowledge to handle complexities.

- Changing Old Processes: Adopting payrolling services can serve several functions, such as reducing manual errors, and streamlining processes, thereby leading to efficient payroll management.

- Maintain Clear Communication: Open channels of communication with employees. Make sure they understand the components of their pay, benefits, and any deductions. This reduces confusion and potential grievances.

- Scheduled Audits: Conduct regular internal audits of your payroll processes. This helps in identifying discrepancies early on and ensures that the system is working as intended.

- Backup and Data Protection: Always have a backup of your payroll data. Invest in robust security measures to protect sensitive information from potential breaches or losses.

Common Pitfalls in Payroll Management and How to Avoid Them

While the path to efficient payroll management is clear, several pitfalls can trip organisations up:

Manual Data Entry Errors

Pitfall

One of the most common sources of payroll errors is manual data entry, leading to incorrect payments and potential compliance issues.

Solution

Transition to payrolling services helps minimise manual entry errors and allows for easy integration with other HR systems for accurate data retrieval.

Missing Deadlines

Pitfall

Failing to process payroll on time can lead to penalties, disgruntled employees, and damage to the company’s reputation.

Solution

Utilise payroll software with built-in reminders or calendar integrations to ensure timely processing and submissions.

Overlooking Compliance Updates

Pitfall

Not staying updated with the latest compliance mandates can lead to hefty fines and legal complications.

Solution

Regularly train your payroll team and consider subscribing to compliance update services or using payroll software that offers automatic updates.

Not Having a Contingency Plan

Pitfall

Unexpected disruptions, like software outages or data breaches, can hamper payroll processing.

Solution

Always have a backup plan. This could involve having backup software, data storage solutions, or even a third-party payroll provider on standby.

The Imperative of Efficient Payroll Management

In the dynamic and intricate world of business operations, payroll management stands as a linchpin. It holds together the very essence of employee satisfaction and organisational reputation.

As we’ve delved into the labyrinth of payroll processes, a few salient points stand out. These help highlight the paramount importance of an optimised system and the arsenal of strategies available to CHROs.

At its core, an efficient payroll function ensures that employees are compensated accurately and punctually. This singular act plays a pivotal role in fostering trust, maintaining morale, and building a positive organisational culture.

When employees are confident in the payroll system’s integrity, it translates to enhanced productivity and loyalty.

Strategies to Navigate Payrolling Services

From our exploration, it’s evident that several strategies can bolster payroll efficiency:

Streamlined Operations and Reduced Errors

Leveraging payroll services not only streamlines operations but also minimises errors and ensures compliance.

Considering Outsourcing

For some organisations, payroll outsourcing emerges as a viable solution, offloading complexities while maintaining impeccable standards.

Staying Updated

Ensuring the payroll team is abreast of the latest regulations and tax codes is non-negotiable for error-free and compliant payroll processes.

Prioritising Training and Communication

Regular training sessions for the team and transparent communication with employees can preempt misunderstandings and grievances.

A Plethora of Solutions for the Astute CHRO

Today’s CHRO is spoilt for choice with a myriad of solutions tailored to diverse organisational needs:

- Payroll Solutions : Ranging from comprehensive software suites to specialised tools targeting specific challenges.

- Outsourced Payroll Providers : Offering a blend of expertise, technology, and flexibility to cater to the unique demands of organisations.

- Regulatory Consultancies: Ensuring that the maze of compliance is navigated with precision.

Take the Next Step in Payroll Excellence

As a CHRO or CEO, you’re at the helm of pivotal decision-making, guiding your organisation through the myriad challenges of the business landscape. One such critical arena is payroll management. The intricacies, compliance mandates, and the sheer importance of getting it right every time cannot be understated.

Start by taking a moment to evaluate your current payroll systems:

- Are they efficient, error-free, and agile?

- Do they seamlessly integrate with other HR functions?

- Is your team constantly grappling with compliance updates or facing challenges in timely payroll processing?

The answer to all of these questions can be found with SAHI. It has relevant experience in the market and provides efficiency payrolling and payroll transfer solutions to reduce errors and make business operations more streamlined. SAHI handles the payroll so that you can focus on the core business.

If you’ve identified any room for improvement or if you’re simply keen on ensuring your organisation is leveraging the best in payroll solutions, it’s time to act.